Estate Planning Attorney for Beginners

Wiki Article

The 10-Minute Rule for Estate Planning Attorney

Table of ContentsThe Estate Planning Attorney StatementsFascination About Estate Planning AttorneyExcitement About Estate Planning AttorneyOur Estate Planning Attorney Statements

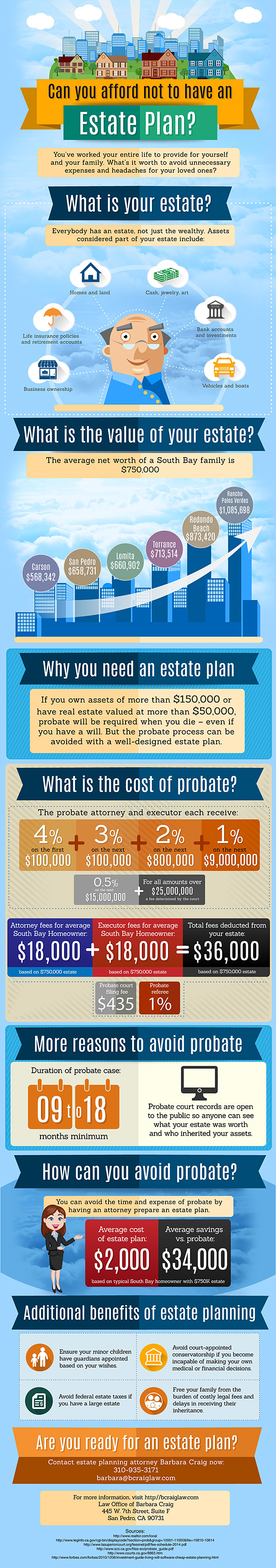

Estate preparation is an action strategy you can utilize to establish what takes place to your assets and responsibilities while you're active and after you pass away. A will, on the other hand, is a legal record that details how possessions are dispersed, who deals with youngsters and animals, and any kind of various other dreams after you die.

The executor also needs to repay any type of tax obligations and financial debt owed by the deceased from the estate. Creditors generally have a restricted amount of time from the date they were alerted of the testator's fatality to make insurance claims against the estate for cash owed to them. Insurance claims that are turned down by the administrator can be taken to court where a probate court will have the last word regarding whether the claim stands.

Facts About Estate Planning Attorney Revealed

After the stock of the estate has been taken, the worth of assets determined, and taxes and financial debt paid off, the executor will certainly then seek authorization from the court to distribute whatever is left of the estate to the recipients. Any inheritance tax that are pending will certainly come due within nine months of the day of fatality.

Each specific areas their assets in the trust and names a person various other than their spouse as the beneficiary., to support grandchildrens' education and learning.

What Does Estate Planning Attorney Do?

This approach involves freezing the worth of an asset at its value on the day of transfer. Accordingly, the amount of possible capital gain at death is likewise iced up, allowing the estate coordinator to approximate their potential tax obligation upon fatality and far better prepare for the repayment of revenue tax obligations.If adequate insurance policy profits are available and the policies are appropriately structured, any kind of revenue tax obligation on the regarded dispositions of properties complying with the death of an individual Read Full Report can be paid without turning to the sale of properties. Profits from life insurance policy that are obtained by the recipients upon the death of the insured are normally earnings tax-free.

There are certain records you'll require as component of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate preparation is just for high-net-worth individuals. But that's not true. Actually, estate planning is a device that everybody can utilize. Estate planning makes it easier for people to establish their desires before and after they pass away. Unlike what most individuals think, it prolongs beyond what to do with properties and obligations.

The Greatest Guide To Estate Planning Attorney

You should start intending for your estate as quickly as you have any kind of measurable possession base. It's a recurring process: as life proceeds, your estate plan need to change to match your conditions, according to your new goals. And maintain it. Refraining your estate planning can trigger excessive financial problems to liked ones.Estate planning is commonly assumed of as a device for the affluent. Estate preparation is check my reference likewise an excellent means for you to lay out plans for the care of your small youngsters and pet dogs and to detail your dreams for your funeral service and preferred charities.

Applications should be. Qualified candidates that pass the exam will certainly be formally licensed in August. important site If you're eligible to sit for the examination from a previous application, you might file the short application. According to the guidelines, no qualification shall last for a period longer than five years. Learn when your recertification application schedules.

Report this wiki page